My first online trading experience was through Sharekhan’s “Classic” web trading application. Many a times, some of the trades in which I was making profit used to turn into losses just because of the slow interface. Only when I switched to their TradeTiger software I realized the importance of using good trading platforms.. Later I switched to Zerodha’s KITE platform because of simplicity and loaded features.

So I thought of compiling a list of best trading platforms in India for 2026 in this article which you may find useful. It includes the details of these trading softwares offered by some of India’s top stock brokers and information about their features.

Before that, let me quickly introduce you various types of online stock trading applications available in India. If you already aware of that, you may skip to next section.

Types of Online Trading Platforms in India:

In India, one can trade online in stock market basically through 3 interfaces. Every major stock broker develops platforms for these three types of interface.

- Desktop : It is the fastest trading platforms compared to other two. You need to install the software in your Desktop/laptop before using it. One can download the software usually from broker’s website. This platform is best suited for those who want to place quick buy/sell orders. It will have shortcut keys (like F1 for Buy, F2 for sell etc) using which a daytrader can initiate the trade swiftly.

- Web: Here you don’t have to install any software. The login page can be accessed using a web url provided by your stock broker. You can even access it at cyber cafe with any of the web browsers like Chrome or Firefox and carry out trading. Only thing is, it is comparatively slower than desktop based platform.

- Mobile Application: Nowadays online trading is difficult to imagine without using mobile. In India, android application is provided by almost all reputed stock brokers. The iOS version is supported by only few brokers. One can install the application from playstore and login using the credentials and carryout trading.

Knowing above, I will cover mainly about desktop and web platforms in this post. I will discuss about mobile platform in a separate article. (Read : Best Trading Applications for Mobile in India)

List of 9 Best Trading Platforms in India – 2026:

Here is the list of best trading platforms in India.

- Zerodha KITE trading platform

- Upstox PRO trading platform

- Angel One Speed PRO trading platform

- ICICI Direct Trade Racer trading platform

- 5Paisa Trader Terminal trading platform

- FYERS ONE trading platform

- Sharekhan TradeTiger trading platform

- Motilal Oswal Trader trading platform

- NSE Now trading platform

Now lets discuss feature of each trading platforms, their pros and cons.

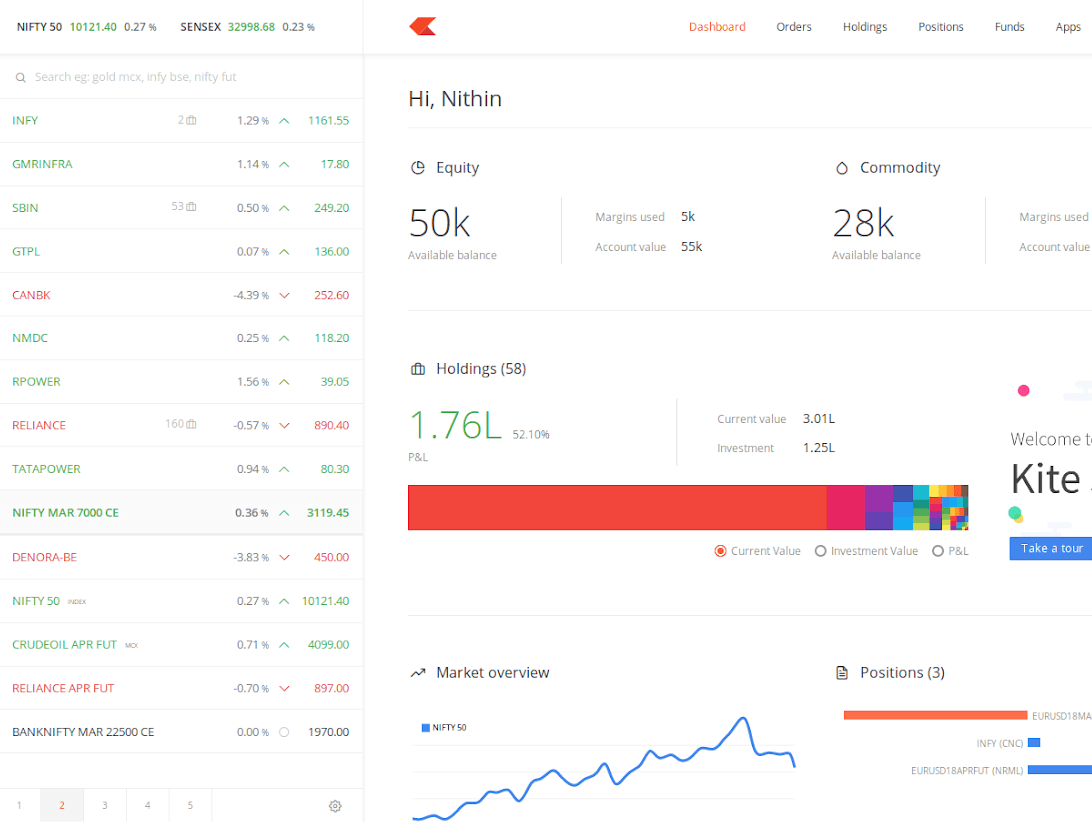

#1. Zerodha KITE:

without doubt, KITE is the best trading platform in India for web and mobile from the No.1 discount broker of India, Zerodha. Previously, they used to offer third party software called NEST which is from Omnesys technologies.

KITE is developed in house from scratch by Zerodha team and if any issues, they would be able to address it quickly.

The reason it is at the top of the list is, it is very light and consumes lesser bandwidth (lesser than 0.5kbps) compared to the platforms from other brokers.

I like the very minimalist interface it provides. The screen is not cluttered with the many items with bright background colors which are really not necessary.

Only drawback I found is, it is not possible to back test your strategies in this platform.

Kite also comes with multilingual and available 11 Indian regional languages.

Some of the other salient features of Zerodha KITE are:

- Technical indicators in excess of 100 and 20+ drawing tools

- 6 different chart types, Helkin-Ashi, Kagi, Linebreak, Point and Figure, Range Bars and Renko

- Any chart can be popped out from the main interface at anytime

- Simple and easy order placement within a single click

- Upto 5 market watchlists each with 20 scrips can be created.

- Integrated with ‘Quant’ – which is another tool by Zerodha helpful in behavioural analytics and fundamental analysis.

- Also integrates with their brokerage calculator, margin calculator, Zconnect and pulse

- They claim to process more than 5 million requests every day.

Pros & Cons of KITE:

Cons:

- Order can not be placed from the chart itself is not possible as of now

- Back testing our trading strategy is not possible

- Multiple minor bugs were reported by the customers using firefox browser

Pros:

- Light weight, intuitive and provides optimal user experience.

- Low on resources, even clients from remote areas with slow internet speed can use it without hiccups

- Multiple indicators, charts and other tools required for profitable trading

- Fund transfer across multiple banks within the interface

Zerodha offers Zero Brokerage on investments and Rs 20/executed order for non-delivery trades (intraday and F&O). I have written a detailed review of Zerodha and their offerings.

How much Brokerage can be saved with Zerodha?

Before we go further, let us see how much savings a investor and a trader can do if he opens an account with Zerodha.

Because of the huge savings and the quality of trading platform(KITE) that Zerodha offers, they are able to overtake the likes of ICICI Direct and Sharekhan to become India’s largest stock broker within 8 years.

For Investor:

If you plan to invest Rs 10 Lakh, with 0.55% brokerage (ICICIDirect charges this much!), you have to shell out Rs5,500 in brokerage itself where as you pay nil in case of Zerodha (Investments are free at Zerodha).

Hence there will be 100% savings in brokerage charges compared to brokers like ICICI Direct.

For Trader:

Now let us see for intraday and Futures traders, how much can be saved.

Let us assume you buy Rs 10lakh and sell 10lakh worth of shares daily. That means in around 20 trading days of month it will be 400 lakhs.

ICICI Direct charges 0.0275% hence the brokerage charges per month is Rs400Lakh * 0.0275% which is Rs 11,000.

So yearly it would be,

Rs11,000 * 12 months = Rs 1,32,000

Now Zerodha charges Rs 20/trade for intraday. In Zerodha, brokerage is not based on trade value. For each order they charge Rs20 irrespective of trade value.

Hence per day it would be Rs 40 (Rs20 for buy and Rs20 for sell) and for each month it would be 20* Rs40 = Rs 800

So per year it is Rs 800 * 12 months = Rs 9,600

Hence, traders can save more than 90% of brokerage and indirectly add to their profit.

Because of these savings and advanced yet simple to use platform, I recommend opening account with Zerodha. I have been using it since 2012.

Zerodha Account Opening Charges:

Account in Zerodha can be opened within 15 minutes if your mobile is linked to your Aadhar number. Check out detailed Step by step procedure on how to open Zerodha account with screen shots

Zerodha has made account opening free with effect from June 29, 2024. Use below link to go directly to Zerodha account opening page to open the Zerodha demat account without any fees.

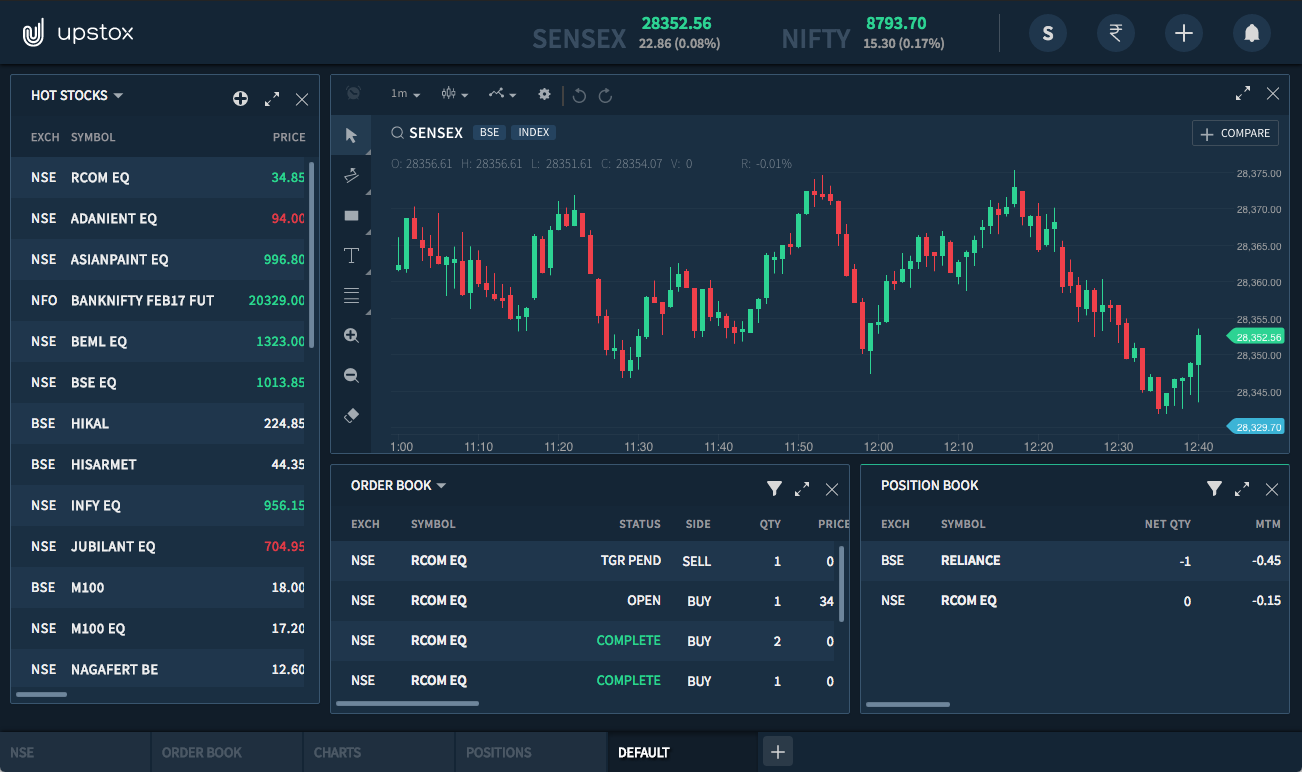

#2. Upstox Pro:

Upstox Pro is one more advanced web and mobile based trading platform from Upstox which are second largest discount broker after Zerodha. They were formerly known as RKSV Securities.

The application uses something known as socket-technology which enables faster access of market date in real time.

The charting can be set from duration 1 min to 1 month. It also comes with more than 10 drawing tools and 105+ indicators.

One interesting feature of Upstox Pro is, you can directly place the order from chart itself by right clicking on the chart. This really helps in avoiding silly mistakes in placing orders and also allow us to concentrate on charts rather than symbols.

It also has one more beautiful feature called drag and drop. Simply hold on the scrip name on left column and drag it to the charting window at the middle. Now the charting window will display the chart of that particular scrip.

It also provided historical chart data of 10 years. So if you are testing any of your trading strategy, it may help to see how it behaved historically.

Pros & Cons of Upstox PRO:

Cons:

- When compared to KITE, using Upstox PRO is slightly cumbersome

- Has few software bugs, but they are adding new update very frequently

- Mutual Fund investment is not possible through this platform (Equity, Currency and Commodity are supported)

Pros:

- Highly customisable themes, layout and alerts can be set.

- Highly responsive, it adjust automatically according to desktop, tablet or mobile screen.

- One can set multiple watch lists at any given time

However, Upstox does not offer Zero Brokerage on all investments, they charge Rs 20/ executed trades.

You can read my complete Uptox Review here.

Upstox currently waiving off the account opening fee. You can open your account free of cost. Use below button to avail the offer.

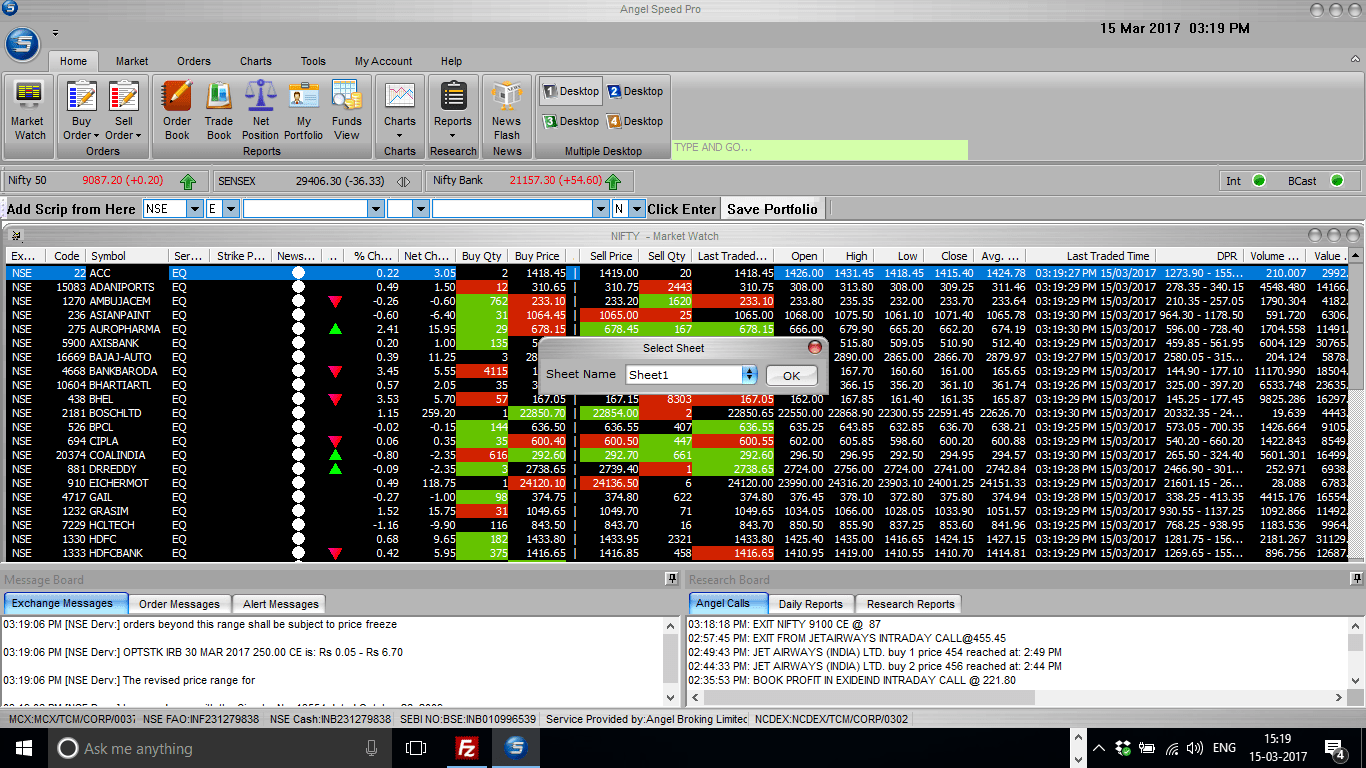

#3. Angel One Speed Pro:

Angel Speed Pro is another excellent trading software from one of the popular stock broker of India, Angel One. It is a desktop based application and hence need to installed by downloading the executable file

Earlier to 2019, Angel One used to charge brokerage on percentage basis. But now they have also following Zerodha model of discount brokerage.

Company charges Rs20/trade and for delivery trade the brokerage charges is Rs0.

Some of the salient features of Speed PRO are:

- Customizable tool bar to control ribbon style menus and quick links

- Live market information can be opened in Excel with rate refresh

- Heatmap, combined five, intraday, historical charts

- Multi desktop options : Same tool can be used in two desktop screens which helps in arranging the chart windows and conveniently switch between two.

- Online transfer of funds with more than 40 banks possible within the software itself

- Access to all account related information such as trade report, portfolio constitution, funds management and back office report

- 30days intraday data, 20 year historical end of day (EOD) data with 70+ studies

Advantages & Disadvantages Angel Speed Pro:

Disadvantages:

- Not supported for MAC versions.

- User interface is not much impressive in comparison to Zerodha Kite

- No much frequent updates adding new features

Advantages:

- Bandwidth requirement is 40kbps , which is nowadays not a big deal ( but still higher than 0.5kbps required for Zerodha KITE)

- I like the multi desktop feature which I explained previously.

- Possible to apply for mutual funds from tool itself

- One can configure the shortcut keys of his own choice for quick trades

- Setting up alerts based on certain user defined parameters is possible

Angel One review: Check out details of Angel One and its offering in this review.

You can use the below link to open account with Angel One without any charges. ( Account opening free of Rs300 is waived off). Also, you get demat account with Zero AMC charges for first year.

![]()

#4. ICICI Direct Trade Racer:

ICICI Direct Trade Racer is a power packed trading platform from the biggest stock broker of India, ICICI Direct. They are the brokerage arm of ICICI Bank and played vital role in popularising online trading in stock markets of India.

Again, Trade Racer is an terminal based trading platform and hence you need to install it before use. It can be downloaded from their website.

TradeRacer provide you with live streaming quotes and research calls along with the multiple watchlists.

You also get access to their fundamental and technical calls through “iClick2Gain” module.

This software has a feature called Trend Scanner feature: It is basically a scanner which helps traders to find the trending scrips as per the condition set.

Interface is highly customizable. One can select his/her favorite colors, grids and layout. It comes with three different views namely, “Analytical view, Derivative View and Equity View”. I think names are self explanatory and you can understand what they mean.

Some of the advanced feature like Heat Map, Live Screener etc are also included.

Pros & Cons of ICICIDrect TradeRacer:

Cons:

- The software is not free. Rs 75 per month is charged towards subscription. Hover this fee is waived off if you generate more than Rs 750 brokerage per month.

- Bandwidth requirement is high. Hence it takes more time to load. Not much suited for the users with slower internet speed.

Pros:

- Provision to add various widgets as required by the trader

- The frequently used widget can be opened with a single click using icon bar

- Information like gross delivery data, advance decline ratio , bulk and block deals which are useful in gauging the market behavior

Check out my detailed review of ICICI Direct with details of their brokerage charges, account opening charges etc.

#5. 5Paisa Trader Terminal:

5Paisa is a discount broker promoted by IIFL (India Infoline). Their trading platform is called ‘Trader Terminal” which provides optimal user experience.

You need to download a .exe file from their website and install in your system.

Compared to web based platforms. desktop based trading platforms are best suited for day traders as they are relatively faster.

5Paisa Trader Terminal is designed keeping easy access to all offerings of 5Paisa.

Some of the salient features of 5Paisa Trader Terminal are,

- Multiple watchlist and each watchlist can be added with 100 scrips

- Multiple and advanced types of orders such as AMO, Cover Order can be placed

- Intraday charts for last 30 days are available

- Fundamental data for more than 5 years

- Information about 5 top bids and asks for any scrip

- Transfer funds from and to the bank account directly from the terminal itself

Pros & Cons of 5Paisa Trader Terminal:

Cons:

- Newly launched platform, hence one can expect stability issues

- Not integrated with third party products

- One should download and install the application unlike web based trading platforms

Pros:

- One can access the recommendations from terminal itself

- Can invest in mutual funds and insurance segments

- Rich technical studies and fundamental data helps users in quick decision making

- Works smoothly as it does not consume much of the system memory

- Traders are allowed to customize the interface to suite their preferences

Read the complete 5Paisa Review here.

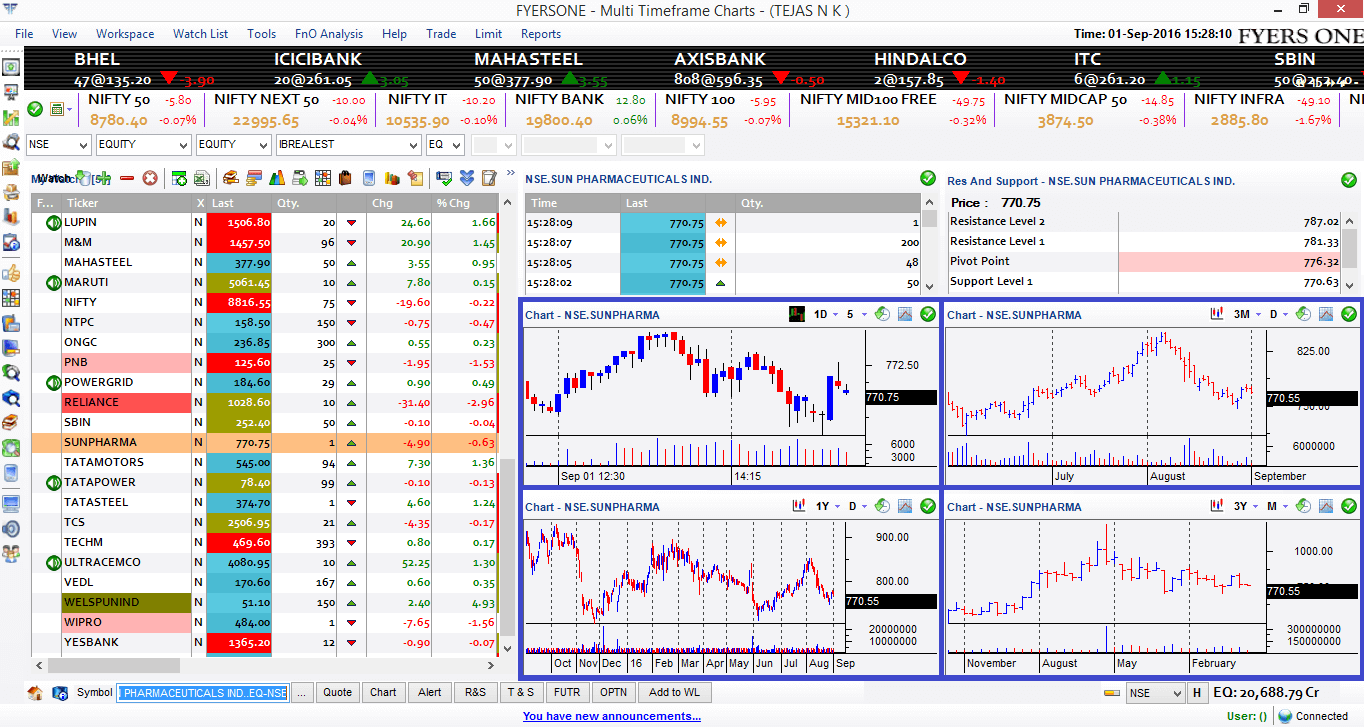

#6. FYERS ONE

FYERS ONE is a desktop based trading platforms from the discount broker FYERS which is based out of Bengaluru. Interestingly FYERS has given tremendous importance to their trading platforms from the beginning.

They have invested heavily in development of one of the finest trading platform of India.

The screener feature is the best part which I like in their software. It can scan and preset a nice trading opportunities. For example, you can scan a scrip which is gapped up by certain percentage above the previous day high etc.

Same can be done for the fundamental analysis also, one can scan with required PE ratio, market cap and returns data.

Read : 9 Best Demat and Trading Accounts of India

Some of the other features are:

- It generates the End Of the Day (EOD) date by after market hours which can be used for trade ideas for next day.

- It has the portfolio simulation feature using which one can build a simulated portfolio and watch its performance without have to invest real money

- Contains the world data on equity indices, ADRS, currencies and commodities

Positives & Negatives of FYERS ONE:

Negatives:

- Not supported for MAC version as of now

- Required advanced system configuration to avoid lag

Positives:

- Availability of simulated portfolio to understand portfolio performance without loosing hard earned money

- There is one module called ‘intraday recovery’ which identifies the scrips which have fallen too much today and have the high probability of recovery.

- Advanced feature such as Heatmap, index meters and stock screener etc make it one of the outstanding trading platforms of India.

FYERS charges Rs 20/executed order similar to Zerodha but entered slightly late to the industry. Check out the complete review of FYERS here at FYERS Review.

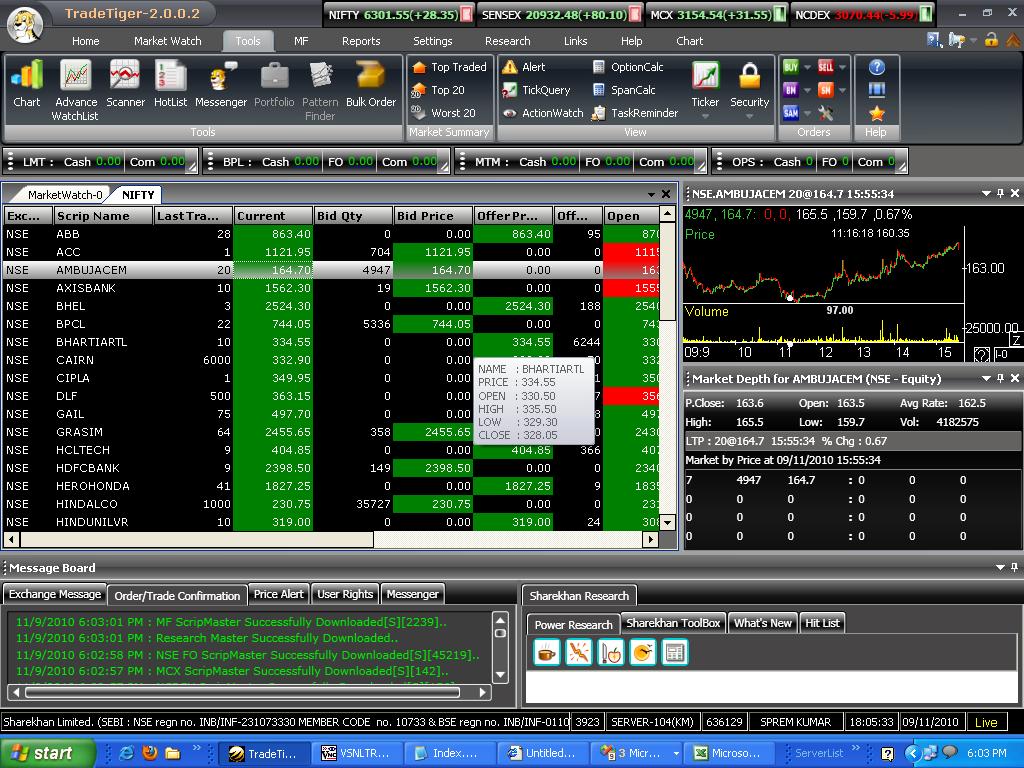

#7. Sharekhan TradeTiger:

TradeTiger from Sharekhan is my favorite charting tool, only because I am used to it from very long time and finding it difficult to switch to Zerodha Kite. So now I use TradeTiger for charting but place order with KITE to save brokerage.

However, you need to install the software in your desktop or laptop before start using it. The .exe file can be downloaded from Sharekhan website.

Some of the Salient features of TradeTiger are:

- Access to Research calls : Get access to all the trading calls from Sharekhan Research desk ranging from day to years and Fundamental to Technical

- Fast and Reliable feeds : Get realtime quotes without delay at microsecond intervals.

- Advance Tools : Live Market Scanner, HeatMap, chart book and more

- Multiple Exchange Platform : Trade at multiple exchange BSE & NSE (Cash & F&O), Currency within the same platform

- Graph studies such as Bollinger bands, average and MACD

- User defined alert settings on input stock trigger price

- Premium calculator and span calculator

- Shortcut keys for fast order placements.

Benefits & Drawbacks of Sharekhan TradeTiger:

Drawbacks:

- I find it very resource hungry. You need a system with high end configuration if TT has to be used along with other applications.

Benefits:

- Video tutorials are available within the tool itself you are stuck at any level

- It also provides information about more than 30 trading strategies

- It is integrated with Sharekhan customer support, you can raise a query within the tool itself

- Some of the advance configurations like, Amibroker trading bridge, API integration, stock screener and trade from MS Excel.

Read Complete review of Sharekhan with information regarding its history, brokerage charges and account opening charges.

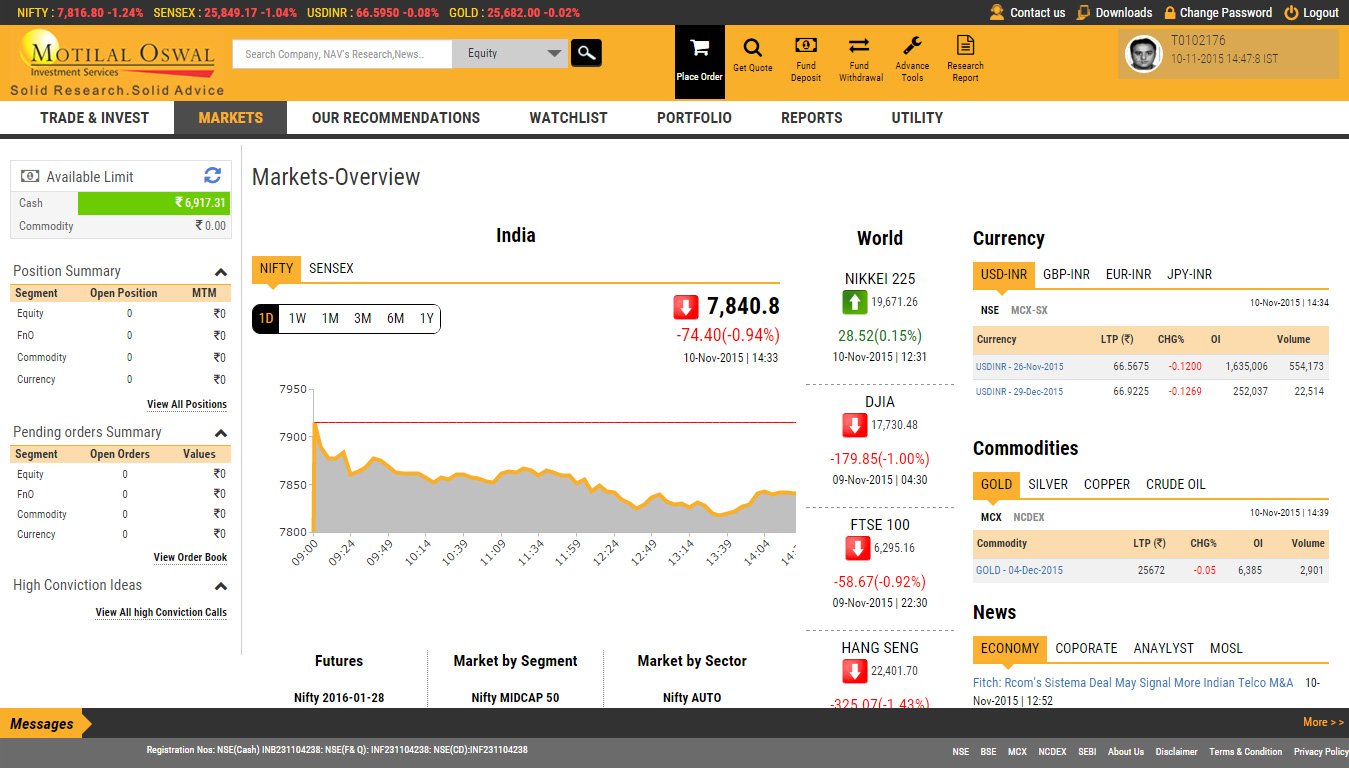

#8. Motilal Oswal Trading

Motial Oswal is a leading stock broker of India with more than 10 lakh customers. Its desktop trading software come with lot of advanced features.

Some of those features include:

- Superfast trade execution with 1 second refresh rate

- More than 40 technical indicators in a single scrip

- Interactive Risk-Return chart to choose from best combination of the portfolio

- Trade guide signal: It generates auto buy/sell signal based on the trend spotting

- Access to more than 30,000 research reports for all asset classes

Pros & Cons of Motilal Oswal Desktop Trading:

Cons:

- It is very bulky, one need to have high system configuration to use it without any lagging

Pros:

- Set alert for individual or group of scrips for a particular criteria

- Multi Asset watch list : You can create watchlists for different sector like equity, derivatives , commodities and currencies

- It has integrated portfolio health check and review tool which helps you in comparing and benchmark your portfolio and restructure it.

Read my complete review of Motial Oswal brokerage here.

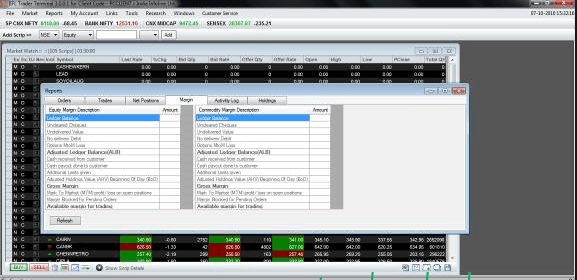

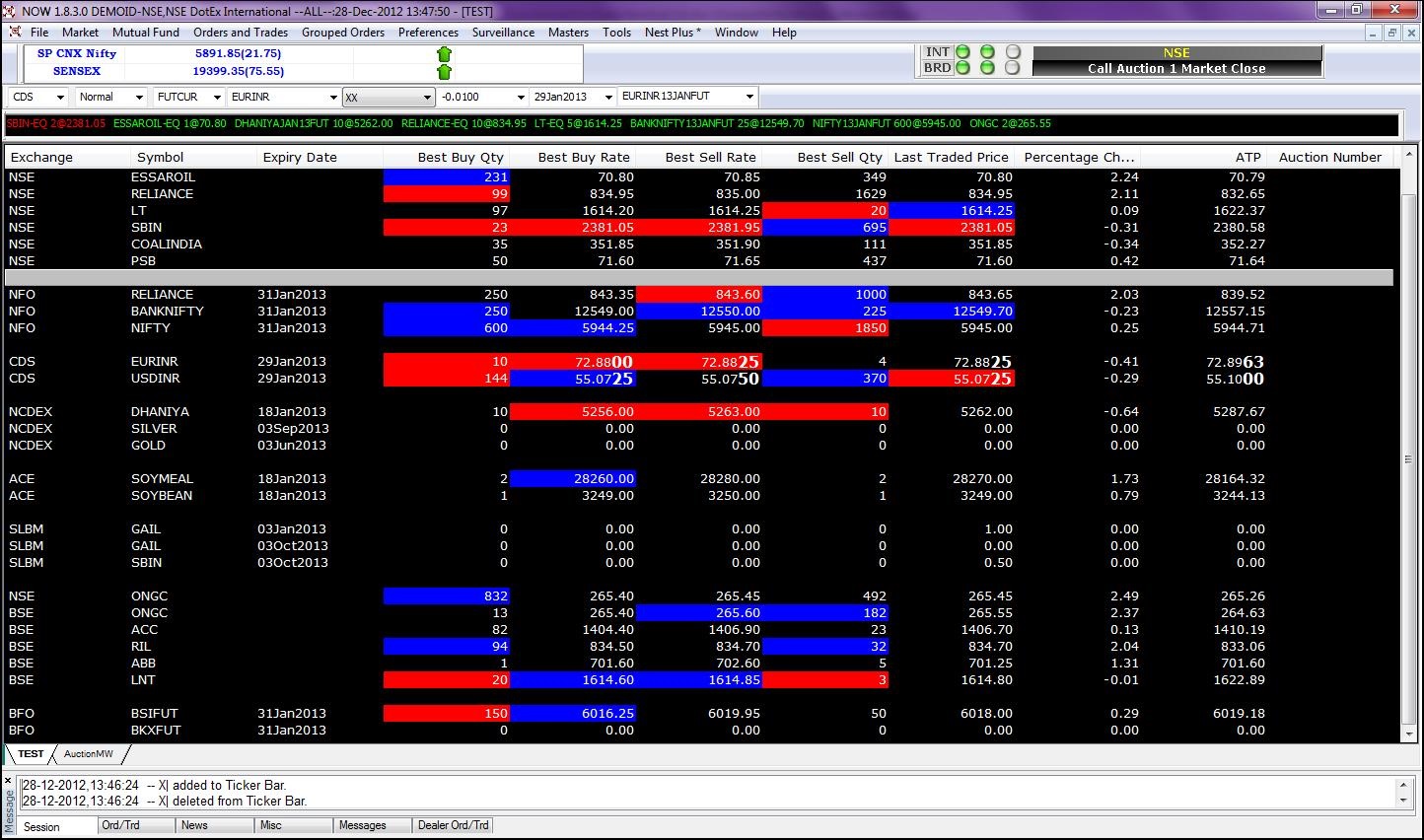

#9. NSE NOW

Unlike other platforms which I listed above are developed by respective stock brokers, NOW (Neat on Web) is a web based trading platform developed by the NSE stock exchange itself.

You don’t have to install any software and can be accessed directly from the prominent browsers like Chrome, Firefox or Internet Explorer.

It is responsive design and hence adjust itself automatically according to screen width of desktop, Tablet and mobile.

The best part is, since it is promoted by NSE, the NOW servers are closer to NSE and hence price are updated slightly quicker compared to trading platforms of other brokers.

Some of the prominent brokers such as Zerodha and Upstox used to offer NSE NOW to their customer by getting license from NSE.

After developing their inhouse platforms, currently they have discontinued NOW. However few brokers like Tradejini etc still provide it to their clients.

Some of the salient features of NSE NOW are:

- 80+ technical indicators and 15+ charts are available

- Create market watch and observe the market behavior

- Create alerts through web notification as per the customer settings

- If your broker offers daily tips, NOW displays the same in its interface

- Less down time and high speed execution of trades.

Pros & Cons of NSE NOW :

Cons:

- Biggest concern is , it can be used to trade in NSE exchanges only. One can not trade in MCX and NCDEX making it not usable to commodity trading

- User experience (UX) is not at all great. It looks very basic and cluttered.

- System configuration requirement is also high

- Some brokers charge their customers for using NOW

Pros:

- 2 Factor Authentication (2FA) login process makes it more secure

- Can be used by both beginners and experts

- Relatively speedy compared to other platforms

Final Thoughts about Best Trading Platforms of India:

About 10 years back, we used pay for the data feeds and buy charting software like Amibroker, Metatraders etc. All those were quite expensive. Thanks to heavy competition among the brokers and advance in technology, traders are getting all these for free.

Infact now it has become difficult to differentiate two platforms on their features as everyone has most of the features.

Online trading is all about designing trading strategy and its perfect execution. All the above platforms are top in class, you just need to select the one which has all the technical analysis tools involved in your strategy.

They have been updating their softwares even though mobile app have come into forefront. But desktop platforms are the ones to use if you are day trader.

I have tried to compile list of some of the best trading platform of India. If you think this list needs to be revised by including or excluding any platform, please let me know through comments.

Along with stocks, I think it is high time to bet on something new but similar like Bitcoin.